Calculate gross profit, reverse GST, percent markdown & markup in Excel Reverse charge in

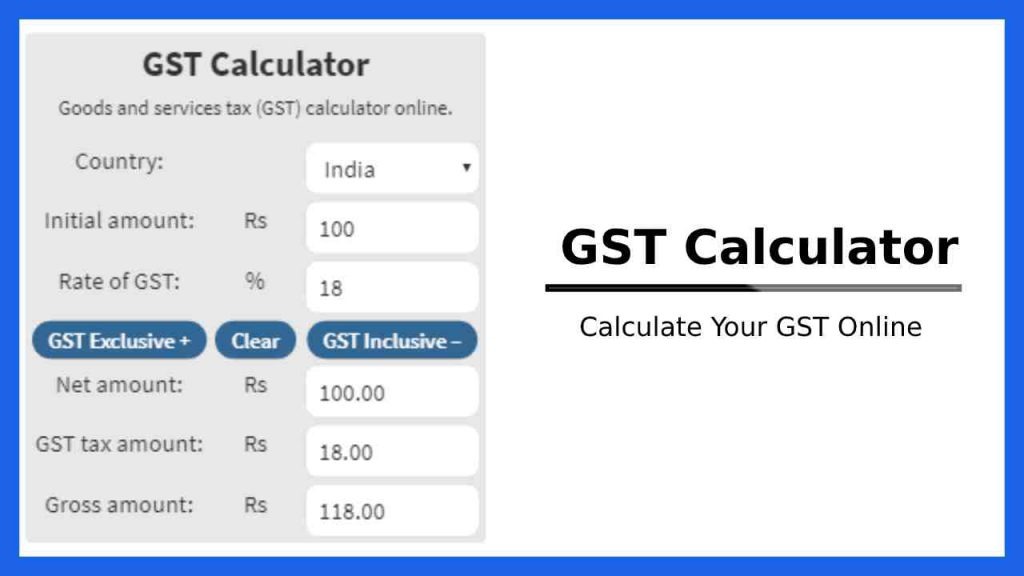

Any input field of this calculator can be used: Enter price without GST - GST value and price including GST will be calculated. OR Enter GST value and get GST inclusive and GST exclusive prices. OR Enter GST inclusive price and calculate reverse GST value and GST exclusive price. How to calculate GST manualy GST calculation is quite simple.

What is the Reverse GST charge? Read about the reverse calculation here

A Reverse GST Calculator is an easy-to-use tool to extract Taxable amounts and GST amounts from MRP or Total Amounts. How to Calculate GST on Total Amount | Calculate GST on MRP There are a lot of GST calculators available online but very few are talking about reverse GST amount Calcuation.

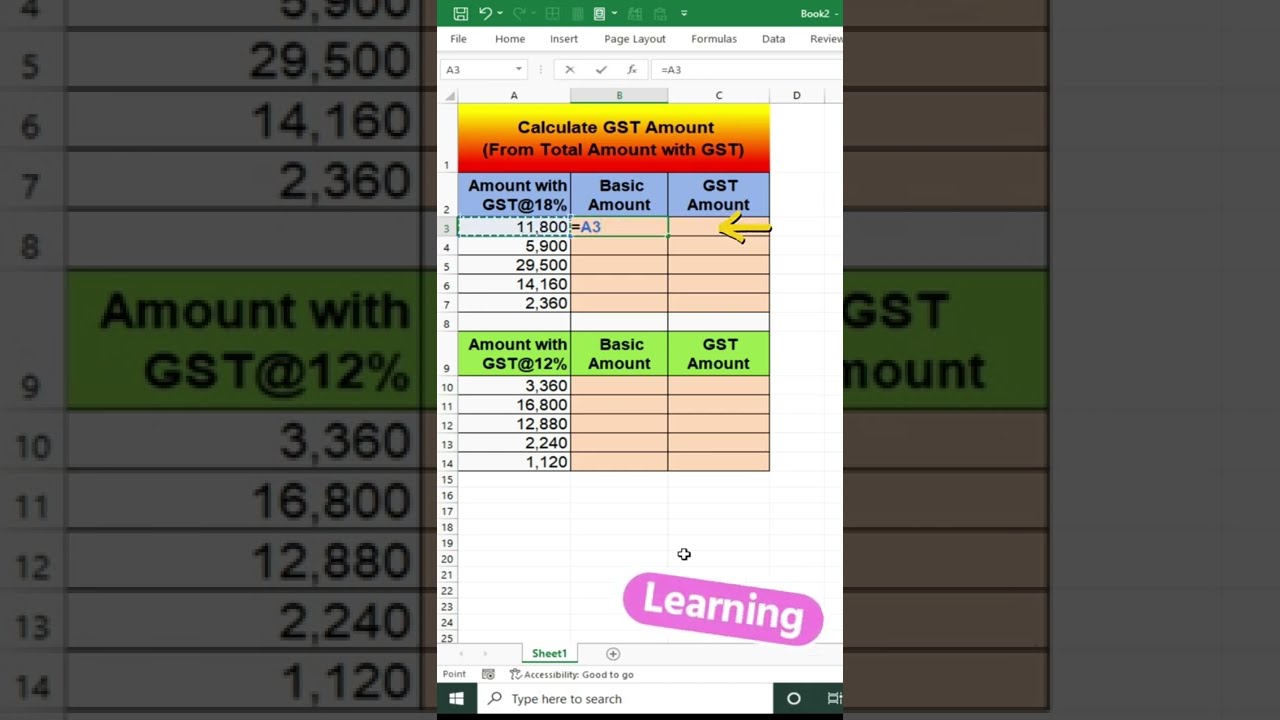

How to Make Reverse GST Calculator In Excel Download GST Calcualtor for Reverse GST

Calculator formula Here is how the total is calculated before sales tax: Amount with sales tax / (1+ (GST and QST rate combined/100)) or 1.14975 = Amount without sales tax Amount without sales tax * GST rate = GST amount Amount without sales tax * QST rate = QST amount Margin of error for sales tax

Reverse GST Calculator PDF

Step 1: Enter the Amount on which GST Rates are included in the topmost field. Step 2: Now select your GST Slab or say GST Rate which is applicable. Step 3: Amount Excluding GST shows the Base Price of any product or service without GST. Step 4: Total GST Amount, this field will show you the Amount which you have to pay to Government.

GST Calculator How to calculate GST? Calculate GST Online

HST reverse sales tax calculation or the Harmonized reverse Sales Tax calculator of 2024 for the entire Canada, Ontario, British Columbia, Nova Scotia, Newfoundland and Labrador and many more Canadian provinces

Make Reverse GST Calculator in Excel Download GST Calculator in Excel for Reverse Calculation

Reverse GST/HST Calculator Total after taxes Province Best 5-Year Fixed Mortgage Rates in Canada Butler Mortgage 4.79 % Get This Rate 6ix Mortgage Group 4.79 % Get This Rate nesto 4.89 % Get This Rate Pine 4.94 % Get This Rate BMO 5.29 % Promotional Rate TD 5.44 % Get This Rate Mortgage Term: 1-Yr 2-Yr 3-Yr 4-Yr 5-Yr Fixed Variable See More Rates

Reverse calculation of GST from Total Amount shorts by srsawaliyaeduworld YouTube

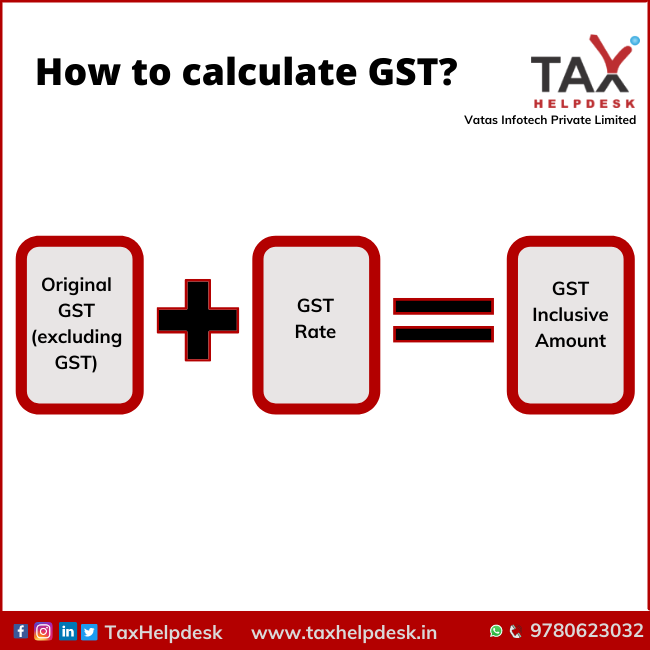

Even a GST credit calculator, will be based on the same principles. Thus, a simple formula arises: GST Amount = (Original Cost*GST Rate Percentage) / 100; Net Price = Original Cost + GST Amount; Inclusive GST calculator. However, in those cases, where a price inclusive is mentioned, a reverse GST calculator will need to be applied.

NZ GST Calculator

It can be used as well as reverse Goods and Services calculator. It is easy to calculate GST inclusive and exclusive prices. What is GST rate in India? Current GST rate in India is 18% for goods and services. There are reduced rates 0%, 5% and 12% for some goods and services, and 28% luxury rate for some items. Special GST rates in India

How To Subtract Gst From Total Amount

To calculate the tax amount: multiply the net price by the GST rate. $40 × 0.1 = €4. To determine the gross price: multiply the net price by GST (again, we'd get €4) rate and then: Add it to the GST exclusive price. €40 + €4 = €44. This is simply a case of an percentage increase calculation, and this is what you'd do in any net to.

GST Reverse Calculator in Excel Excel Tips and Tricks in Hindi Advanced Excel Tricks Vky Malik

To calculate GST payable after deduction of Input tax credit use our GST Payment and Input tax credit calculator.. So you have to pay a GST on reverse charge of Rs. 900 (5,000 x 18%). If CGST & SGST is to be levied then CGST & SGST of Rs. 450 each is to be paid. TaxAdda Private Limited

Solution of GST Reverse Charge applicability in TallyERP.9 Tally Knowledge

GST Inclusive Price - GST Amount = [GST Inclusive Price x {100/ (100 + GST Rate Percentage)}] When is a reverse charge applicable GST reverse charge is applicable in the following cases: The first case (Goods are supplied from unregistered to registered person)

GST calculator It's All Widgets!

Singapore's goods and services tax (GST) was increased from 7% to 8% as of January 1, 2023. As a result of COVID-19 Australian government implementing relief options to support business. This one is related to monthly GST credits. Luxury rates was also added to our Indian GST Calculator. It took almost 17 years to introduce GST in India, but.

REVERSE CHARGE IN GST

Reverse Sales Tax Calculator Price with Tax: $ Sales Tax: % Answer: Price before Tax: $ 1,500.00 + Sales Tax (6.25%): + $ 93.75 Total Price with Tax: $ 1,593.75 Solution First, convert tax percentage to a decimal tax rate = 6.25% / 100 = 0.0625 Then use the formula to calculate the price: list price = total ÷ (1 + tax rate)

GST Reverse Calculator Microsoft Excel, calculator How to Make GST Reverse Calculator in

1 minutes On this page This calculator explains: How to calculate goods and services tax (GST) in Australia The amount of GST you will pay or should charge customers The price excluding GST and the total cost including GST Australian GST calculator Price Amount GST status Results Assumptions toggle accordian row Do you find this page useful? Yes No

GST reverse calculation YouTube

1. Instead of Entering the fair value in the " Amount in Rupees " field, input the price that already includes the GST rate. 2. Below that, specify the percentage you want to remove. 3. Click on the " Reverse GST " button. 4. Both the GST rate and the original price will be shown separately.

Reverse GST Calculator How to Calculate Reverse GST? LegalDocs

Reverse GST Calculator is a mathematical-based financial tool that determines the bill amount of goods and services, excluding tax. This tool helps in figuring out the pre-tax cost on the basis of the GST-inclusive amount and an applicable GST slab rate.